Western Transportation Safety Consulting Ltd.

in Lethbridge

On April 25

at 8:49 AM

Fire extinguisher recall affects more than 10,000 International tractors. More than 10,000 International tractors are being recalled as part of the massive Kidde fire extinguisher recallthat was initiated in November. Trucks equipped with Kidde plastic-handle or push button “Pindicator” fire extinguishers are included in most recent recall from Navistar, according to National Highway Traffic Safety Administration documents. These fire extinguisher models could become clogged, preventing them from discharging properly. Additionally, in certain models, the nozzle can detach from the valve assembly with enough to cause injury. The Navistar recall is for 10,195 of the following International year and model tractors: • 2000-2001 International 4700 • 2000-2002 International 4900 • 2001-2003 International 9100I • 2002-2003, 2005, 2007-2009, 2012-2014, 2016-2018 International Durastar • 2018 International LT • 2012, 2014-2017 International Prostar • 2014-2015 International Terrastar • 2001-2003 International Transtar According to NHTSA’s documents, Navistar began notifying affected truck owners on Feb. 9. Kidde is responsible for replacing the fire extinguishers. Owners of affected truck models can contact Navistar customer service at 1-331-332-1590 or Kidde customer service at 1-855-271-0773. NHTSA’s recall number is 17V-792. More information from Kidde on which fire extinguishers are included in the recall can be found here. Read the full article by Matt Cole from Overdrive Online at: https://goo.gl/WNoPWx

Western Transportation Safety Consulting Ltd.

in Lethbridge

On April 23

at 12:44 PM

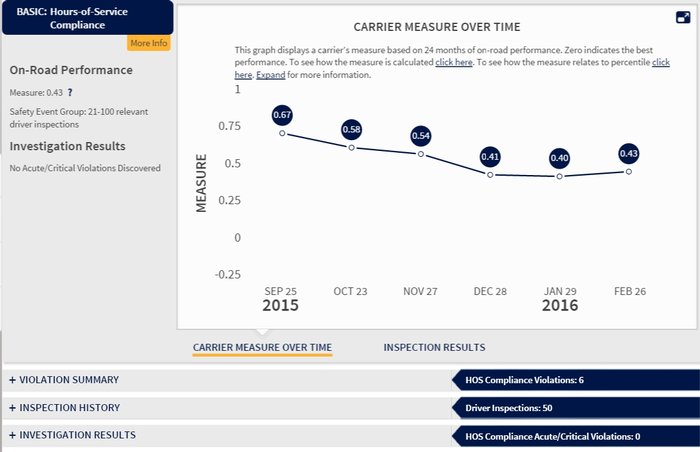

FMCSA updates CSA SMS with new ELD violations, releases severity weights. As of April 1, new violations associated with the Federal Motor Carrier Safety Administration’s electronic logging device mandate are now associated with the Hours of Service Compliance BASIC category in the CSA program’s Safety Measurement System, the agency noted. “These violations are not being applied retroactively; violations recorded prior to April 1, 2018 will not be counted in SMS,” though carriers having received a violation for not having an ELD on board and in use should pay close attention to the code utilized on the inspection report. If the violation was issued before April 1 with a code that is something other than 395.22(a), as Overdrive has reported, such situated carriers may have ground for a DataQs-system challenge to have the code changed to remove the violation (often encoded under 395.8 or 395.15 sections) from scoring in the system. Motor carriers that have received ELD-related violations post-April 1 will “start to see them reflected in their HOS Compliance BASIC in early May 2018,” FMCSA says, “when the next monthly SMS results are released.” With the most recent update, several new violations are available and severity weights associated with them in the internal safety-scoring program have been determined and newly published. Among them are new code variations on the 395.8(a) violation incurred for having no record of duty status/no logbook when required, all of which come with a 5 (out of 10) severity weight, two additional points added when an out of service order is associated. **395.8A-ELD, having no logbook when an ELD is required **395.8A-NON-ELD, the same violation but incurred when an ELD is not required (such as in the case of an ELD-exempt truck) **395.8A1, incurred for not using the appropriate method to record hours of service A complete list of the ELD violations and their severity weights, the majority of which are very low 1 weights, is available in the SMS Appendix A spreadsheet, which you can download via this link. The primary CSA SMS Methodology document, FMCSA says, will be updated following the May data update. See the full article by Todd Dills from Overdrive Online at: https://goo.gl/8T72x5

Western Transportation Safety Consulting Ltd.

in Lethbridge

On April 20

at 6:42 AM

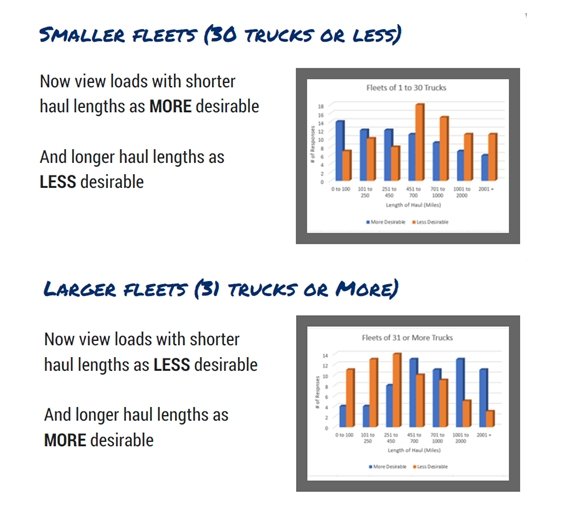

ELD-related survey shows length-of-haul desirability trending shorter for small fleets, longer for large. The Columbus, Ohio-headquartered Zipline Logistics freight brokerage has been in business about a decade, working mostly with food and beverage brands and suppliers of ingredients and materials as shipper customers. Zipline recently surveyed its carrier network, comprised of both small and comparatively large fleets, about the turn to electronic logging devices made of course dramatic by the Federal Motor Carrier Safety Administration’s ELD mandate. Survey results, based on responses from more than 100 carriers, show something of a shift in thinking depending on the size of the carrier when it comes to the desirability of longer or shorter hauls. A principal difference in responses of fleets of 30 or fewer trucks and those with more than 30 trucks shows a mirror image centered on what have been called the “dangerous lanes” for solo drivers utilizing ELDs — those runs that are able to be completed by a solo driver reliably in a single day within the hours of service limitations. In Zipline’s survey, it asked repondents to indicate certain lengths of haul as either more or less desirable since the turn to ELDs for hours of service tracking. Smaller fleets, where Zipline believes solo drivers are something of a norm in its carrier base, in large part indicated runs of shorter length were now more desirable to maximize productivity. Larger fleets, conversely, showed the opposite pattern, which Zipline attributes to a variety of factors in its analysis of its particular carrier base. “For both sets” of survey respondents, “the length of haul desirability flips at the 451-700-mile mark” in the graphs of carrier responses, Zipline says. “It is in that range that for many smaller fleets (mostly comprised of solo drivers), a load goes from a one-day point to a two-day point. The extra day of transit poses a high opportunity cost for these carriers, opportunity costs that carriers with larger driver pools can avoid by keeping these lanes to a one-day transit,” whether through team operations or relay systems. He didn’t get there until much later, however, and when in recent years he trained and went out on the road with his daughter, this past year he began to really see teams’ value, hitting $10,000-$16,000 in weekly revenue to the truck hauling in a 2007 Volvo 780 leased to a small Chicago-based fleet that specializes somewhat in expedited freight. Just before he shut down for some winter time off, however, he also lost his codriver, who’s expecting a child and had to go off the road. At MATS, Carnahan was hopeful to find a codriver as “it’s an open checkbook for teams” in the business of trucking today, he believes, given the ability to provide near-straight-through service on most any load. Regarding rates on longer and shorter-hauls both, however, Carnahan believes what we’re seeing today “is not the new normal. Trucking is the barometer of the economy, and the economy is pretty good but it’s not that good. Give it another year or two at the most.” Once carriers on the smaller side of fleets are able to adjust, either bringing on more of those golden-ticket teams, setting up relays for longer runs or otherwise specializing in short hauls — “it’s harder to find a team than it is to set up a relay,” he believes — Carnahan sees competition among carriers bringing rates back down. Improved rates, as has been remarked upon by no shortage of industry watchers and participants both, are probably a lone bright spot in what’s been an otherwise difficult transition for many. Zipline’s survey reflected the reality, too: While large majorities saw rates on the uptick, 84 percent of all respondents at once noted company personnel (including driver) morale was significantly down. Among that group, 71 percent noted productivity was down, 87 percent said it’s now much more difficult to make deliveries on time and 84 percent said the dispatch process has gotten more cumbersome, more difficult generally. Read the full article online at: https://goo.gl/2swzpY

Western Transportation Safety Consulting Ltd.

in Lethbridge

On April 19

at 1:41 PM

A few points on scoring better rates from owner-operator coach Kevin Rutherford. http://www.youtube.com/watch?v=vfK05BxLRGM Small fleet owner turned owner-operator coach Kevin Rutherford presented three seminars in late March at the Mid-America Trucking Show on running a more profitable small trucking business, fleshing out over three hours of talks a litany of advice on landing better rates, building relationships with brokers and, simply, driving up bottom lines. Here are a few themes that emerged from Rutherford’s seminars. To score better rates, control what you can control: As in his seminars in years past, Rutherford noted that brokers nor owner-operators dictate rates. Rates are based almost exclusively on supply and demand, he says. “85 percent of a rate is supply and demand. The other 15 percent is your ability to provide value and to negotiate.” In the trucking economy, supply is the number of trucks available, and demand is the number of loads that need to be moved. More available loads puts upward pressure on rates, as does fewer trucks. Fewer loads — and more trucks — would then put downward pressure on pricing. However, within that 15 percent lies owner-operators’ opportunities to score better rates and boost their profitability, Rutherford says. Operators should develop a keen understanding of the supply and demand forces for the lanes they run and the geographical areas where they are and where they want to go. “15 percent may not sound like a lot, but if you gross $178,00 a year, and you’re able to take advantage of the 15 percent that’s out there, that’s another $28,000 a year,” — much of which should go to your bottom line, he says. Operators also need to learn to negotiate with brokers — and learn that brokers are their customers. Know your customers — and provide real value to them: “Who are your customers?,” Rutherford asked. “Brokers.” Like in all other businesses, owner-operators need to develop strong relationship with their broker customers, Rutherford said. He recommends targeting a few brokers and marketing yourself to them. “My goal when I had trucks was to work with five brokers a year — that’s it. Because now I can focus on those relationships and I can get to the freight that really is the stuff I want.” Truckers should make their value known to brokers — become a “problem solver,” for them, he says — and brokers will be more likely to throw the best loads your way. Operators should take their brokers out for coffee or lunch occasionally, he says, as a means to separate themselves from their competition. “How do [you] provide more value than anybody else? And what can you do that nobody else can do for their customer?” Avoid deadheads at all costs: Rutherford, as in past seminars, harped on a common owner-operator refrain, “Say no to cheap freight,” arguing it can do more harm than good for owner-operators’ bottom lines. “It’s ignorant and you have to stop thinking that way,” he said. “It’s a horrible way to run a business.” Instead, owner-operators should find loads, even if they just cover costs, that put them in position to score better loads and better rates. Operators should also stop balking at so-deemed cheap freight, which could leave them deadheading or sitting and waiting. “Deadhead is the ultimate cheap freight — you get paid nothing. You want to minimize sitting and waiting for things to get better, and don’t pass up loads that keep your truck moving and get you back into a better lane.” Concentrate on the “really important stuff”: Many truckers who venture into owner-operator businesses think “being really good trucking is all it takes” to be successful, Rutherford says. “It’s not about trucks — it’s about business, and that’s where we fail in this industry.” Owner-operators often get bogged down in what Rutherford called “the stuff” — tasks such as DOT registrations, IFTA, UCR filings, permits, signage, insurance and the like. To run more successfully, operators should concentrate on “the important stuff” and “the really important stuff,” says Rutherford. The “important stuff” includes setting up a good accounting system, knowing your businesses numbers (revenue per mile, net revenue per mile, fuel costs, etc.) and defining their business model. The “really important stuff” includes marketing your business, identifying your broker customsers and working on what makes you the most valuable to them. “You have to build your business around your strengths. Find out what your strengths are and start focusing on that. It’ll make you happier and far more successful,” he says. “Ninety-nine percent of people focus their time, energy and money on the stuff. One percent will focus on the really important stuff.” Read the full article online at: https://www.overdriveonline.com/a-few-points-on-scoring-better-rates-from-owner-operator-coach-kevin-rutherford/

Western Transportation Safety Consulting Ltd.

in Lethbridge

On April 16

at 10:21 AM

Do you need training or meeting space in Lethbridge? Western Transportation Safety Consulting Ltd. has a meeting/training room available for rent! Our rental space seats approximately 20-25 people in a table-seating setting, or can accommodate 30-35 individuals for theatre-style seating. Our rental package includes full use of our white boards and projector, as well as offering coffee and tea for your events (please inquire for snack and meal options as an add-on). Our daily room rental fee is only $125.00 and we would be happy to provide you with more information. Please contact us today at: Western Transportation Safety Consulting Ltd. 2825E 2 Avenue South Lethbridge, AB T1J0G8 (403) 320-1086 office Toll Free 1-844-320-1086

Page 4 of 20